Looking for a Credit Card?

The Bank of Baroda offers a range of Credit Cards that cater to the needs of every individual!

Top benefits of :

✅ Attractive reward points

% Amazing deals & discounts

🛍 Exclusive benefits for subscriptions, travel & food

Why you should apply from here:

✔ Fast processing

✔ 100% online process

Apply now to get your BOBCARD –

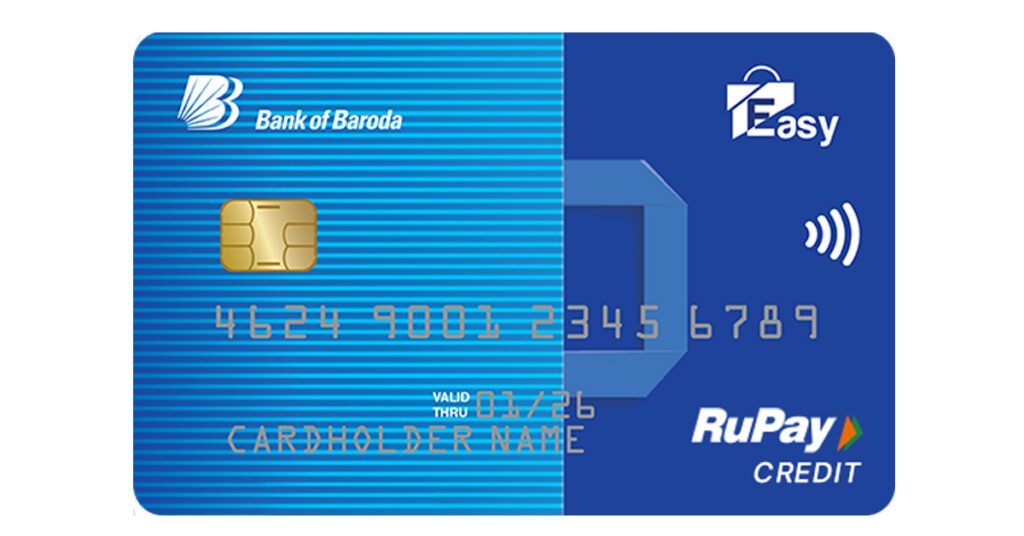

The BOB Easy Credit Card is a simple and rewarding credit card offered by Bank of Baroda.It’s designed to make your everyday spending easy and rewarding, with features like fuel surcharge waivers, accelerated rewards, and easy EMI options.

Key Features and Benefits

- Lifetime Free: This card is completely free for life! You won’t have to worry about annual fees.

- Fuel Surcharge Waiver: Enjoy a 1% fuel surcharge waiver on all fuel purchases between Rs. 400 and Rs. 5,000.

- Accelerated Rewards: Earn 5X reward points on online shopping, dining, and utility bill payments. This means you can earn more rewards on your daily spending.

- Easy EMI Options: Convert your purchases of Rs. 2,500 and above into easy EMIs of 6 or 12 months. This can help you manage your expenses better.

- Multiple Redemption Options: Redeem your reward points for cashback, gift vouchers, or other exciting rewards.

How to Get the BOB Easy Credit Card

To apply for the BOB Easy Credit Card, you can:

- Visit a Bank of Baroda Branch: Visit your nearest branch and fill out the application form.

- Apply Online: You can also apply online through the Bank of Baroda website or mobile app.

Eligibility Criteria

To be eligible for the BOB Easy Credit Card, you must:

- Be an Indian resident.

- Be at least 21 years old.

- Have a good credit history.

- Have a stable source of income.

Fees and Charges

While the card itself is lifetime free, there are some other fees and charges to be aware of:

- Joining Fee: Rs. 500 (Reversible)

- Annual Fee: Rs. 500 (Waived on spending Rs. 35,000 in a year)

- Finance Charges: Interest is charged on outstanding balances.

- Cash Advance Fee: A fee is charged for cash withdrawals.

- Foreign Transaction Fee: A fee is charged for transactions made outside India.

Important Considerations

- Responsible Spending: Always use your credit card responsibly and pay your bills on time to avoid late fees and interest charges.

- Credit Limit: The credit limit on your card will be determined by the bank based on your creditworthiness.

- Terms and Conditions: It’s important to read the terms and conditions of the card carefully to understand all the fees, charges, and benefits.

Overall, the BOB Easy Credit Card is a great option for individuals who want a simple and rewarding credit card. With its lifetime-free status, fuel surcharge waiver, and accelerated rewards, it can help you save money and earn rewards on your daily spending.