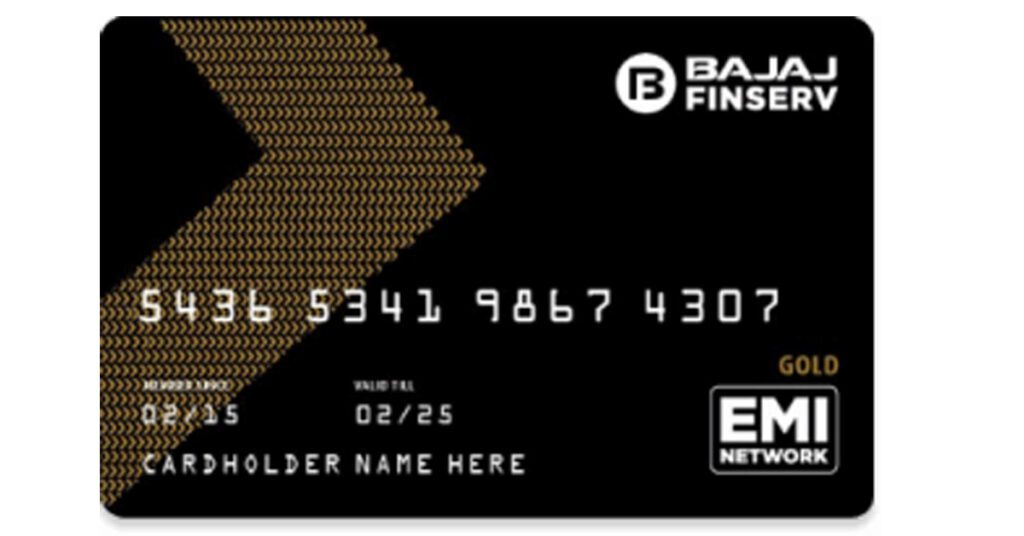

The Bajaj EMI Card is a digital credit card offered by Bajaj Finserv, through which you can convert your purchases into easy EMIs. It is a good way to fund your purchases without the burden of a large upfront payment.BAJAJ EMI CARD

Key Features of the Bajaj EMI Card:

Pre-approved Limit: You get a pre-approved loan limit of up to Rs. 3 lakh, which you can use to make purchases across various categories.

Flexible Repayment Tenures: You can choose flexible repayment tenures between 3 to 24 months as per your budget and need.

Widespread Acceptance: The Bajaj EMI Card is accepted across over 1.2 lakh online and offline partner stores, including e-commerce websites, and retail outlets.

No Down Payment: You may often get no down payment offers on selected products which makes it easy to purchase high-value products.BAJAJ EMI CARD

Easy Online Application: The Bajaj EMI Card application process is swift and simple, and you can do it totally online.

How to Use Bajaj EMI Card:

Apply Online: Get the card from the website or app of Bajaj Finserv.

Approved: After getting approved, get your digital card details.BAJAJ EMI CARD

Shop Online or Offline: You can shop using your card at stores that are a part of the network.

Convert to EMIs: Your purchase will get auto-converted into easy EMIs as per your chosen tenure.

Benefits using Bajaj EMI Card

Easy Budgeting: You can easily manage finances since your purchase cost has been divided into smaller EMIs.BAJAJ EMI CARD

No Hidden Charges: The Bajaj EMI Card has no hidden charges and no fees for using it.

Quick and Easy Process: The entire process, from application to approval and usage, is hassle-free and efficient.BAJAJ EMI CARD

Exclusive Offers: Bajaj Finserv often offers exclusive discounts and deals to its cardholders.

Overall, the Bajaj EMI Card is a convenient and affordable way to finance your purchases. If you’re looking for a flexible and hassle-free credit solution, the Bajaj EMI Card is worth considering.BAJAJ EMI CARD